Here, we will track the real performance of Cambridge University’s endowment over time and isolate the impact of administrative spending growth above inflation.

We express values in constant 2025 pounds, taking inflation into account through CPI index, and we benchmark investment performance against the MSCI World Index.

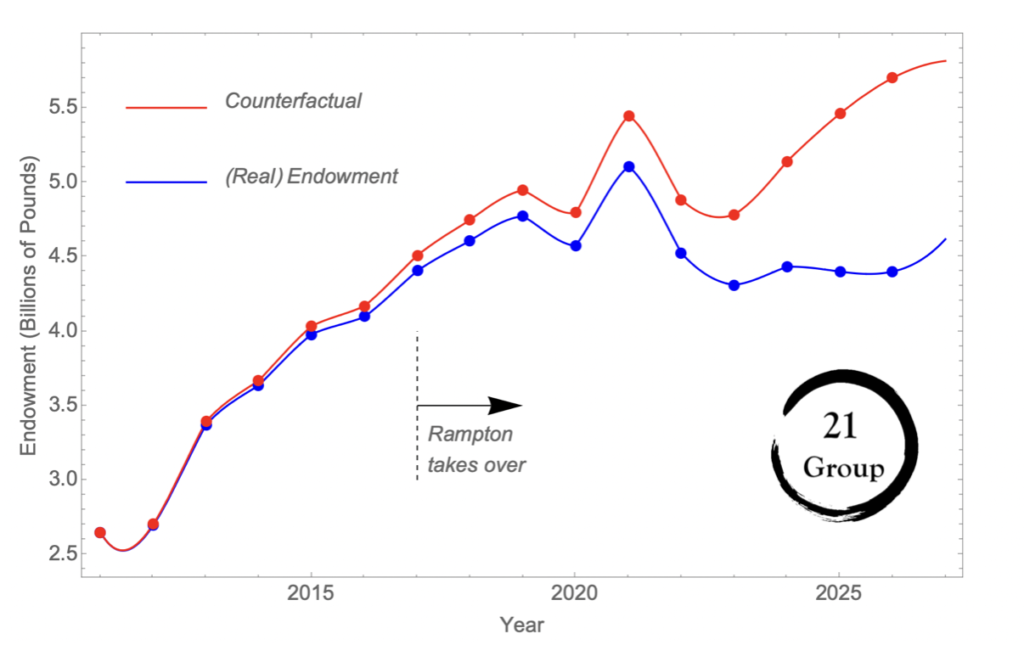

We show a counterfactual scenario as to what the endowment would have been if administrative costs had been frozen in real terms at their 2011 level. The gap between the actual and counterfactual endowment values represents the cumulative opportunity cost of excess real administrative spending, showing how above inflation administration growth compounds into materially lower long-term endowment value.

Under this scenario the endowment would now be GBP 1.3bn larger than it is, or about 30% greater than the current level. Instead of growth, the real value of the endowment is more or less flat over the past decade. (For reference, Ms Rampton takes over as Registrary in 2017).

Table 1. Estimated impact of administrative spending above inflation on endowment value

| Year | Actual Endowment (£bn, real 2025) | Counterfactual Endowment (£bn, admin spend inflation-capped) | Cumulative Excess Admin Spend (£bn, real) | Implied Endowment Shortfall (£bn) |

|---|---|---|---|---|

| 2011 | £2.65 | £2.65 | £0.00 | £0.00 |

| 2015 | £3.98 | £4.03 | £0.11 | £0.06 |

| 2020 | £4.57 | £4.79 | £0.40 | £0.22 |

| 2025 | £4.40 | £5.46 | £0.95 | £1.06 |

| 2026 (projected) | £4.42 | £5.70 | £0.95 | £1.28 |

Notes:

1 All figures are June 30 each year (date of reporting for CUEF). The 2026 figures are a projection, not audited outcomes.

2. The estimates for the “freeze” scenario assume that starting in 2012, admin budget would be indexed in line with inflation at its 2011 level. Any surplus would then be invested in the MSCI World Absolute returns index with currency hedging to offset any variation in the GBP-USD exchange rate.

3. The 2026 counterfactual endowment is a conservative projection based on applying the observed 2025–26 real investment return of the actual endowment to the inflation-capped counterfactual path. No additional excess administrative spending beyond the 2025 cumulative level is assumed.

By 2020, cumulative administrative spending above inflation is associated with an estimated £0.22 bn reduction in the real value of the endowment relative to an inflation-capped spending path. By 2025, it is £1.06bn. These are secure numbers.

On a like-for-like investment basis, the cumulative opportunity cost associated with above-inflation administrative spending is projected to be about £1.3 bn in real terms by end of 2026.

13 Comments

ByeBye · 4 February 2026 at 20:26

Should the infographic be alternatively entitled : Why She Had to Go? 😉

Noer · 4 February 2026 at 20:33

Of course, Rampton was surrounded by cronies and yessers, like the Peakophant and Lavrentii Beria

They have done huge damage, drawn gigantic salaries and many are still there.

TheResearcher · 4 February 2026 at 21:28

There must be a misunderstanding because Ms Rampton did a great work according to the Vice-Chancellor of the University! Of course, the Vice-Chancellor may be clueless, or worse, she may be very well aware of the real impact of Ms Rampton and her colleagues but in good Cambridge fashion, put it under the carpet. If the latter, there is no difference between them. Let’s remember what Prof. Prentice told us recently:

https://www.cam.ac.uk/notices/news/update-on-university-registrary

“I would like to personally thank Emma for the enormous hard work, dedication and expertise she has brought to the role over the past eight years, and to wish her well in her future plans… During her time at Cambridge, Emma’s influence and impact have been truly significant… She has steered Cambridge through significant periods of organisational change… Her enthusiasm for, and commitment to, the development of people has had a hugely positive impact on many staff and the wider professional services community at Cambridge. We are very grateful for everything that Emma has done for the University.”

I am particularly confused by Ms Rampton’s contribution to the “development of people” and the “we” in the last phrase of the VC. We the Golden 50 or other collective? I would gladly ask her who “we” includes exactly, but I am pretty sure she will not reply.

21percent.org · 4 February 2026 at 21:43

As regards

https://www.cam.ac.uk/notices/news/update-on-university-registrary

The statement sounds as though it was dictated through gritted teeth by a cabal of lawyers.

TheResearcher · 4 February 2026 at 21:55

Of course, before she “stepped down,” Ms Rampton may well have asked, in addition to a large sum of money, that her image was presented as such, and in return she would keep some of her secrets. But what will happen after the court and the tribunal trials in 2026? I guess we have to wait and see.

21percent.org · 4 February 2026 at 22:00

She is one of the cast at Bury St Edmunds 1-28 June 2026.

She will be cross-examined by a KC.

TheResearcher · 4 February 2026 at 22:14

Make sure that the KC asks her, as Paula Vennells was asked in the context of the Post Office scandal, “How could you not have known?”

zyflot · 5 February 2026 at 01:37

Lawyers who did her a huge favour though. Could have made a clear case for misconduct in office, and saved us the severance package.

It might have resulted in a legal case – and that’s why we avoid this wherever possible – but this seems a rare instance in which the golden goodbye package likely comes in much more expensive, and without much likelihood of reputational harm (if anything the opposite) given all the scandals coming out, and the huge number of current and former staff who were harmed during the past decade and will be ready to talk.

Mongoose · 5 February 2026 at 01:57

Agreed, in a years time she will pop up as CEO of the National Trust or Great Ormond Street Hospital or something, and proceed to ruin a new organization in the same way as Cambridge University.

The only public statement from the University seems to indicate she was a great success (“Emma’s influence and impact have been truly significant“). Nothing could be further from the truth. Her removal is the first constructive act that the Vice Chancellor has taken.

The Pinch · 4 February 2026 at 23:29

I don’t think staff realise just how badly this had affected them.

By my calculations, if that extra 1.3bn were now available, the university could afford to pay all staff – yes, all the way up to the Vice Chancellor – a 12% salary increase every year for the next decade.

And that is assuming the money provisioned for this would earn no return above inflation until disbursed.

Assuming real returns at 3-5%, by contrast, we could be looking able to afford a 15% pay rise across the board.

Not just for staff earning at the low end, but 15% extra pay too for all Pro VCs, Heads of School, and yes, even the Head of HR and new Head of Registrary as well.

We could all be golden. Sobering to think about.

21percent.org · 4 February 2026 at 23:59

That is a superb way of bringing home the serious damage that has been done to everyone.

Keep Talking · 5 February 2026 at 02:01

Brilliant work this is smashing analysis

Think though your figures are too low.

The cost of the administrative “ramptpage” isn’t just the investment income forgone

The real costs are qualitative and intangible i.e. years of recurrent industrial action, low morale, staff attrition, managerial time burned up in hiring replacements and temporary staff, grievances, coercion, mounting legal costs, loss of grant income due to PI departures

Those things cannot easily be quantified and much the damage will have a long tail over years ot decades

But at a stab I’d say those costs are at least the same size in monetary terms.

The university we could have had would likely be able to generate enough revenue to 30-40% higher salaries

21percent.org · 5 February 2026 at 07:59

“ramptpage”, LOL, very good